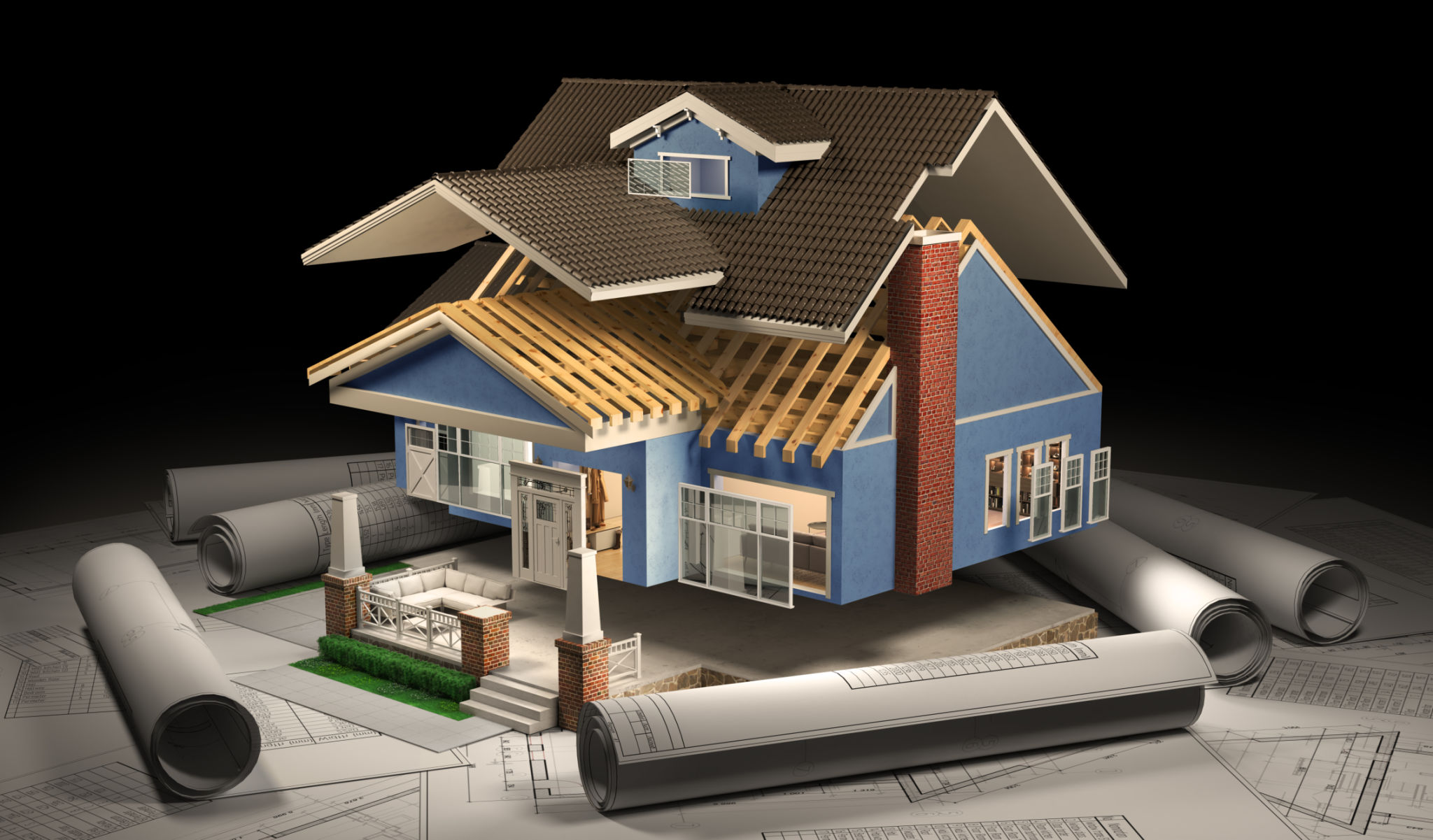

Invest in Your Home, Secure Your Future: Home Renovation Loan Invest in your home and secure a brighter future for you and your family.

ST

Home renovation loans have become an increasingly popular option for homeowners looking to enhance their living spaces. By securing a loan specifically tailored for renovations, you can transform your home into a more functional, aesthetically pleasing, and energy-efficient space. But beyond the immediate benefits, a home renovation loan is an investment in your future.

Understanding Home Renovation Loans

Home renovation loans are financial products designed to help homeowners fund the improvement of their properties. These loans can cover a wide range of projects, from minor updates to major overhauls. The primary benefit is that they allow you to invest in your home without having to use your savings or liquidate investments.

Types of Home Renovation Loans

Several types of loans are available for home renovations, each with its own benefits:

- Personal loans: Unsecured loans that can be used for any purpose, including home improvements.

- Home equity loans: Secured by the equity in your home, often offering lower interest rates.

- Home equity lines of credit (HELOC): Provide flexibility, allowing you to draw funds as needed.

- FHA 203(k) loans: Government-backed loans specifically for renovations on homes purchased with an FHA loan.

Why Invest in Home Renovations?

Investing in home renovations can significantly increase the value of your property. This is particularly important if you plan to sell your home in the future. Upgraded kitchens, bathrooms, and energy-efficient enhancements are known to boost a home's market value. Moreover, a well-kept home can attract potential buyers more quickly and command higher prices.

Enhancing Quality of Life

Home improvements can also greatly enhance your quality of life. Whether you're adding more space for a growing family or redesigning a kitchen to suit your culinary ambitions, the changes you make will benefit your day-to-day living. Moreover, by improving energy efficiency, you can reduce utility bills and create a more comfortable environment year-round.

Planning Your Renovation Project

Before taking out a home renovation loan, it's essential to plan your project carefully. Start by setting a realistic budget that includes a buffer for unexpected expenses. Then, prioritize projects based on necessity and potential return on investment. Consulting with professionals can provide valuable insights into what improvements will add the most value to your home.

The Role of a Professional Contractor

Hiring a reputable contractor can make or break your renovation experience. A professional will ensure that the work meets local building codes and is completed on time and within budget. Always seek recommendations, check references, and confirm that the contractor is licensed and insured.

In conclusion, home renovation loans offer a practical way to enhance your property while investing in your future. By carefully selecting the right type of loan and planning your renovation projects wisely, you can enjoy both immediate benefits and long-term gains.

https://homeloanprime.com/contact